When applying for a car loan thanks to a car dealership or individually with a lender youre subject to new lender’s particular terms and you can criteria to possess approval. Unless you meet these types of terminology there’s your own application was declined.

Not merely is it good discouraging processes as you will you need discover a different way to money your new car, but now your credit rating is even negatively influenced.

So what is the factors that an auto loan app you may become rejected and you may so what can you will do to stop the application taking disapproved? I’ve come up with the major step 3 reasons for having application rejection and you may what you can do to be sure you earn an educated loan for you.

1. Not enough earnings

When looking to buy a different auto just be sure to determine how much you can already afford centered on your earnings and you can savings. The common vehicles cost around australia will surely cost doing $30,000, yet not, this will be determined about precisely how far you really can afford, your position and you can wants. You can read our guide to possess a very intricate publication about precisely how much you really need to dedicate to a new auto.

- Provider finance, If you’re buying a different automobile out-of a car dealership and you can would like to money straight from new dealership’s picked credit supplier. Fundamentally, this one offers less rates however, a higher danger of your how do you get medical school loans application getting rejected.

- Private money, implementing personally which have a lender of your choice separate away from dealership investment. In the event that to purchase a good car or truck or looking around to find the best speed you are seeking to implement physically which have loan providers courtesy private loans.

Loan providers have a tendency to determine whether you are an excellent applicant to provide finance never to simply according to the count you earn immediately after taxation as well as your outgoing costs week towards the times.

- Almost every other finance that you are paying off, such. home loans, individual fund.

- The amount of dependents you may have

- The amount you spend toward restaurants, debts and you will deluxe issues

- How long you have been on the latest a position

- When your income changed within the last six months like. jobkeeper allocation

Loan providers should determine whenever you are capable pay the money for every single loan. Providing lender statements might possibly be must show your credit potential. If you don’t meet the requisite conditions to the financing count expected loan providers might charge you a beneficial cosigner in order to ensure payments could be made.

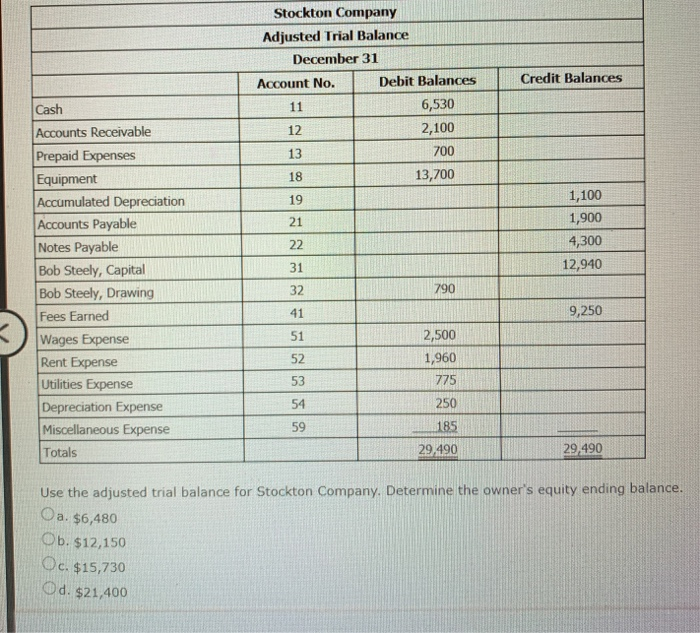

2. Bad credit rating

Your credit rating is your novel identifier how loan providers come across their viability as a customers. Lower than is where your credit score are examined according to research by the rating.

The fastest answer to check your credit score is through into the 30 seconds you can examine your own score free of charge in the place of impacting your credit score.

When you yourself have a dismal credit rating off defaults within the payments or case of bankruptcy you may be less likely to end up being recognized for an auto loan. Discover loan providers that provide you with auto loan in the event that you really have less than perfect credit, not, they’ll fundamentally ask for a higher 1st deposit otherwise a beneficial leading cosigner because the insurance coverage to make certain repayments is repaid timely plus full.

When you are trying to get financing along with your software program is declined, your credit score is negatively inspired. Anytime a lender needs access to your own credit history can also be effect your credit rating thus applying for several financing during the same day would be harmful to the next credit capabilities.

step three. Completely wrong recommendations otherwise partial docs

When obtaining a loan you might be expected thorough and in-breadth questions to get an exact picture of just who you are along with your financing strength. This post whenever completed numerous times a variety of applications is also feel monotonous and you will go out-ingesting.

Whilst every lender will demand comparable necessary guidance (licenses number, lender comments, earnings, and you may payslips), for each bank possesses its own techniques based on how they discover advice and also the structure where it is needed.

If for example the information offered to the financial institution at all is incorrect or will not match your papers there can be a leading options the job would-be denied. Lenders are particularly alert to swindle and you may making certain he’s got the guidance had a need to verify their defense.

How do i be sure my car loan application will never be declined?

CarClarity try become and you can will verify far more Australian’s have the right loan and will be approved the first occasion towards right bank. Inside the doing so i serve to treat the 3 greatest causes as to why 1 in 5 mans auto loan applications try rejected.

Shortage of money – Set

As the Australia’s merely particular on the web bank investigations our company is your representative services. I’ve developed our personal proprietary smart matching technical to give you only a knowledgeable alternatives regarding financial options predicated on the earnings, expenditures and you can facts. Our very own advantages will likely then give you the better of the individuals financing selection according to the lifetime of the borrowed funds title, max deposit count, and you may whether or not a good cosigner could be had a need to hold the greatest price loan.

Less than perfect credit score – Repaired

All of our wise technical does a flaccid look at of your own credit get, definition we will see an accurate image of your current credit score instead impacting they at all. So it mellow take a look at ensures the fits is appropriate centered on their information and certainly will just provide the selection in which you is recognized having. No further last-moment letdowns and you can rejections due to your current score.

Completely wrong advice otherwise incomplete Docs – Set

100% on the internet process, you will simply have to fill in step 1 app, sometimes online otherwise due to a amicable customer support agencies. We shall style the program according to research by the lender’s standards and you can be certain that most of the recommendations and you may records are gotten before delivering it on lender. Zero back-and-forth, zero wrong advice. Probability of our user’s car and truck loans getting disapproved because of not enough records negated.

To be certain your application to own auto loan finance is approved new first-time and each date start an application which have CarClarity today.

Zaheer ‘s the Inventor and you will Chief executive officer regarding CarClarity, Australia’s very first true car finance platform with a simple on the internet application processes. Zaheer features more than 14 several years of experience with senior administration and you will exec ranks for the monetary room. The guy dependent CarClarity from inside the 2019 to address the new unjust gap and not enough transparency the guy seen in the car funding business, in which conventional loan providers have been commonly place profit margins more consumer outcomes. Zaheer is additionally an avid automobile partner who has got owned ten cars in the as much decades. His love of autos along side their business studies will bring a great book insight into the car purchasing and you may funding space.