Lenders typically don’t greeting home loan applications out-of previous students having loads of personal debt, limited income and you may little or no a position background. However, if the individuals try freshly fledged physicians, particular loan providers can offer special physician mortgage programs that may overlook financial obligation, end up being flexible from the money and performs record and even skip standards to possess a large advance payment and financial insurance coverage.

While you are a unique doctor seeking help with your money, as well as mortgage loans and mortgage repayment, envision dealing with a monetary coach.

As to the reasons Medical practitioner Funds?

Whenever physicians are just getting started, they frequently has actually substantial education loan loans, limited coupons and their first perform is generally just like the interns or residents that simply don’t pay far. Because of these limitations, they frequently find it difficult trying to find loan providers who will fund purchase of a property.

For this reason, specific finance companies usually relax the lending criteria of these borrowers in expectations of development a long-title relationship which might be prolonged to add resource pointers and other services.

Medical practitioner Financing Has

You to definitely common feature out of a physician mortgage ‘s the casual demands for a down payment. Most financing software require borrowers to put down about 3% of one’s house’s speed given that a deposit – and regularly need a lot more. Shortly after in college for many years, young medical professionals normally have little savings to make use of because the down payment. Doctor mortgage software address you to through financing which have only a small amount given that zero off.

And additionally, most consumers need to pay to possess individual financial insurance (PMI) when the putting down less than 20% of the residence’s price. But not, medical professionals using one of these programs will won’t have to possess to expend PMI despite no cash down. Yearly advanced having PMI can also be come to 1% of your own house’s well worth, so this potentially is a huge discounts.

Physician financing programs are tend to ready to settle down personal debt-to-money (DTI) criteria for financing approval. Basically, loan providers want a great DTI proportion out of just about 43%, exhibiting brand new debtor possess committed no more than anywhere near this much out-of their money so you’re able to monthly premiums towards playing cards and you can almost every other funds.

However, doctors often accumulate higher student loans while you are generating medical amounts. This means that, of many provides higher DTI percentages. Ds will accept large DTI rates to possess doctor borrowers very they’re able to be eligible for mortgage loans.

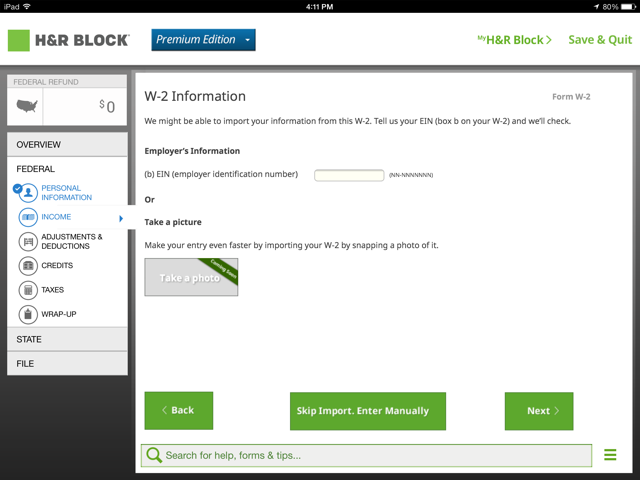

Loan providers additionally require extremely candidates to prove a position and you may be certain that their income, generally speaking by providing W-dos forms or paycheck stubs. But not, medical professionals being employed as owners, interns and you can fellows is generally recognized for a financial loan whenever they can display smaller facts, such as for instance an agreement out of work.

Medical practitioner Mortgage Limitations and you can Dangers

Doctor fund keeps tall constraints also risks. In the first place, they generally just are around for individuals with generated scientific grade instance:

- Meters.D. – doctor away from treatments

- D.O. – doc off osteopathic treatments

- P.A. – medical practitioner pop over to this web-site assistant

- Letter.P. – nurse specialist

- D.D.S. – doctor out of dental science

- D.V.M. – doctor regarding veterinary medicine

- D.P.M. – doc podiatric treatments

- O.D. – doc out of optometry

Particular mortgage applications encourage other positives with a high coming earnings potential, along with designers and you may app designers. However, extremely profession-particular financing software target healthcare benefits.

Other limit off physician financing applications is because they can only just be employed to get an initial quarters. They cannot finance acquisitions away from money spent or a holiday family.

Just like the physician loan programs commonly require little or no advance payment, people focus on little guarantee. It indicates in the event the home prices refuse also slightly, the buyer will get owe more about the mortgage than the domestic will probably be worth.

Such money will often have highest rates of interest first off than simply other fund. It means fundamentally a doctor financing could cost over an identical antique loan.

Additionally, medical practitioner loan applications generally have variable rates of interest. It means doctor borrowers are in danger of experiencing and work out high home loan repayments in a few decades in the event the financing appeal rate changes.

Ultimately, of several loan providers do not offer medical practitioner funds. You can view an online selection of loan providers that provide doctor loans here.

Realization

Medical practitioner home loan programs assist has just minted doctors or any other medical care benefits see family purchase funds towards the advantageous terminology. Doc applications should be approved with little or no down percentage and you will despite high debt and you will limited work records. Borrowers might not have to pay personal mortgage insurance policies too. However, doc finance often have highest rates of interest than other funds, and you can costs are also usually adjustable.