Student loan Cash out Re-finance

Education loan Cash-out Re-finance, Let your family pay back the student loans. The bucks you really need to graduate throughout the scholar debt are proper inside your front door which have finest prices than simply a beneficial old-fashioned dollars-out re-finance! You may already know you to refinancing your home financing will help websites your less home loan interest, but what you will possibly not discover could it possibly be can also rating your dollars to repay the balance of figuratively speaking. PRMI’s Education loan Cash-out Refinance can be end your own student loan repayments and get your top terminology to suit your mortgage payments, everything in one effortless purchase. Start-off today by contacting brand new John Thomas Party at 302-703-0727 otherwise Implement Online.

The application can be found with a federal national mortgage association Traditional Financing to the your existing first quarters. In order to be considered you should meet with the pursuing the direction:

- Need to have lowest 620 Credit score

- Top Quarters Re-finance Simply

- Maximum Financing to Worth try 80% LTV

- Should have had your house for around 1 year

- Must pay from one or more education loan completely

- Max dollars so you’re able to debtor during the closure was $2,000 or 2% of one’s mortgage harmony, whichever is less

- Do not Pay back another loans

- Limited which have a federal national mortgage association Traditional Loan

By conference such standards, you could make use of a cheaper way to combine the student loans along with your mortgage, potentially protecting thousands along side life of your loan.

What are the Great things about the fresh new Fannie mae Education loan Dollars-Away Re-finance?

Merging college loans and other debts along with your home loan isn’t really an effective new build-people have come doing it for years. What’s changed, whether or not, is the cost of doing so when you wish to blow regarding student loan debt.

In past times, debt consolidation reduction by way of a money-aside refinance often came with highest rates of interest owing to exactly what are named loan peak rates changes (LLPAs). not, Fannie mae features a choice which will somewhat lower your will set you back if you use a finances-out refinance particularly to pay off student loan loans. This package enables you to supply rates like people provided towards the zero-cash-out refinances.

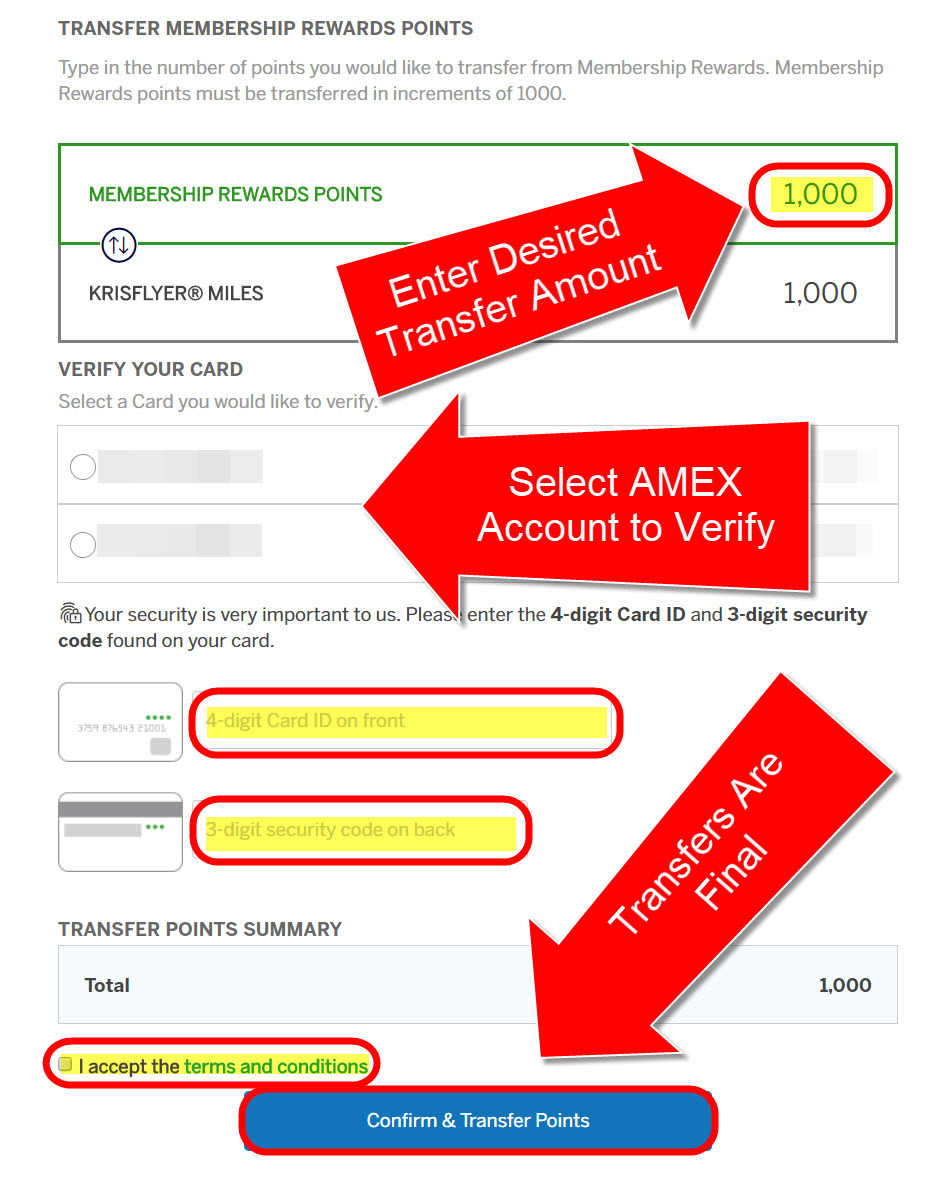

Example Education loan Cash-out Refinance

Inside example, this new borrower do meet the requirements as Financing in order to Really worth (LTV) are lower than 80% whenever combining current financial, closing costs as well as the student loan.

not, when your consumer’s education loan are $50,000 instead then re-finance would not works since the this new loan matter do meet or exceed the fresh new limitation of 80% restriction LTV.

If the buyer got two college loans in the $twenty-five,000 for every single to have all in all, $fifty,000 then your refinance you will continue to work with only paying among student education loans to have $twenty-five,000.

Comparing Fundamental Dollars-Away and you can Student loan Bucks-Out Refinances: How much Might you Conserve?

Fannie Mae’s assistance is exposure-situated fees known as Financing Top Rate Customizations (LLPAs). These types of charge are generally high to possess practical cash-out refinances, leading loan providers to boost rates to purchase will cost you.

Yet not, if you use the brand new unique Federal national mortgage association cash-away re-finance to pay off student loans, the new charges is actually a lot more straight down. Particularly, if you have an effective 700 credit score and an enthusiastic 80% loan-to-value proportion, you can save yourself as much as $step one,375 for each $100,000 borrowed than the a fundamental dollars-aside re-finance. That it difference you’ll lower your interest rate from the approximately 0.5% to a single%.

The latest coupons are alot more tall to own individuals which have lower borrowing scores. If you have a credit rating from https://paydayloanalabama.com/theodore/ 660, you can conserve so you can $2,250 for every $100,000 borrowed, resulting in a speed which is step one% to just one.5% below a basic dollars-away refinance.

How do Your own Apply for new Education loan Re-finance?

If you find yourself wanting finding out additional info or even get so it Fannie mae Student loan Cash-out Refinance next supply the John Thomas People having No. 1 Domestic Home loan a visit from the 302-703-0727 or Apply On line.