Of numerous loan providers impose financial overlays towards the Va finance, and therefore consider a lot more home loan guidance not in the very first requirements put by Virtual assistant agency.

Bank overlays towards Virtual assistant funds try higher lending conditions by individual financial that’s far above minimal Va department recommendations.

Private loan providers can establish its certain lender overlays having Virtual assistant loans. Lenders always lay their lowest credit history conditions having Va money, as the Va does not have the very least requirement. Such requirements usually start around 620 so you can 680. That it remains the circumstances even though the Va will not mandate a specific lowest credit history. If you are searching getting an excellent Va mortgage which have five hundred fico scores, it is essential to mention lenders offered such as scores, because they may vary inside their overlays.

Only a few Va Loan providers Have a similar Credit rating Conditions to the Va Funds

Accepting one to Va lenders will vary within credit rating requirements try essential. If one financial rejects their Virtual assistant loan with five hundred fico scores application, it does not indicate a new won’t approve your.

Gustan Cho Partners has a nationwide reputation for having the ability to meet the requirements and agree mortgage loans most other loan providers dont create. This is due to the zero lender overlay coverage towards government and you can loans in Columbine conventional funds.

During the Gustan Cho Couples, more 80% in our consumers experienced pressures with other loan providers because of history-second mortgage denials otherwise overlays. All of us assists individuals within the securing recognition getting Virtual assistant finance, despite credit scores as little as 500 FICO and you will a poor credit records. Gustan Cho Lovers try a high-rated national mortgage company invested in no financial overlays into Virtual assistant funds.

Delivering Approved towards the Virtual assistant Loan With five hundred Fico scores

To safe a beneficial Va loan five-hundred credit scores, mortgage lenders need certainly to check if individuals meet the Experts Administration’s minimum company mortgage direction. These tips try to be set up a baseline, and you may loan providers can create additional credit standards, known as financial overlays, that is much more stringent versus minimum standards put because of the the latest Va.

Gustan Cho Lovers has a financing network along with 210 general mortgage brokers. I’ve those wholesale mortgage brokers that no financial overlays with the Va fund.

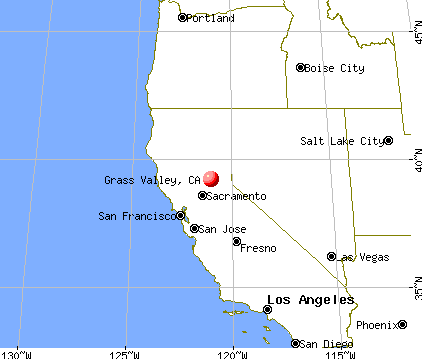

Gustan Cho Associates try a home loan providers one to works within the forty eight claims, including Washington, DC, and you will Puerto Rico. That unique aspect of Gustan Cho Associates is that they carry out not impose lender overlays on the Va money. He’s got made a national reputation for their exceptional capability to assistance to mortgage loans you to definitely almost every other loan providers tends to be incapable need to simply help assists.

Lowest Financial Direction For Virtual assistant Mortgage Approval

- 100% investment and no money off

- There aren’t any minimal credit score requirements with the Virtual assistant financing

- It holds so long as this new debtor will get approve/qualified for each and every the automatic underwriting program (AUS)

- Only no. 1 proprietor-renter attributes meet the criteria

- Next belongings and you will capital attributes are not entitled to Virtual assistant financing

- There aren’t any maximum loans-to-earnings ratio limits into the Va money.

The selections and charge-out of accounts need not be distributed out to qualify having Virtual assistant fund. Virtual assistant finance support instructions underwriting. Homeowners when you look at the a dynamic Section 13 bankruptcy installment package can be be considered having a great Virtual assistant financing.

Virtual assistant Fund To own Less than perfect credit

Candidates having a beneficial Virtual assistant Loan with five hundred credit scores need to be experts, effective armed forces employees, otherwise partners that have valid certificate from eligibility. The existence of a great selections and you may recharged-away from accounts doesn’t demand fee. After the A bankruptcy proceeding case of bankruptcy, foreclosure, deed-in-lieu regarding foreclosure, otherwise quick marketing, there is a two-12 months waiting period. Virtual assistant fund offer probably the most lenient guidelines among individuals mortgage loan applications.