Purchase your brand new home that have Experts Joined.

We’re going to help you to get the best from your own Va loan work for. Va customers normally tap into the latest industry’s lower average repaired pricing and get that have $0 downpayment.

We shall always examine to have discounts to you personally.

The lower-Speed Radar features tracking rates even after you close in your home. Get alerted in MyVeteransUnited when a reduced rate and you can discounts was thought. dos

Protected the fresh new straight down costs: timely & effortless.

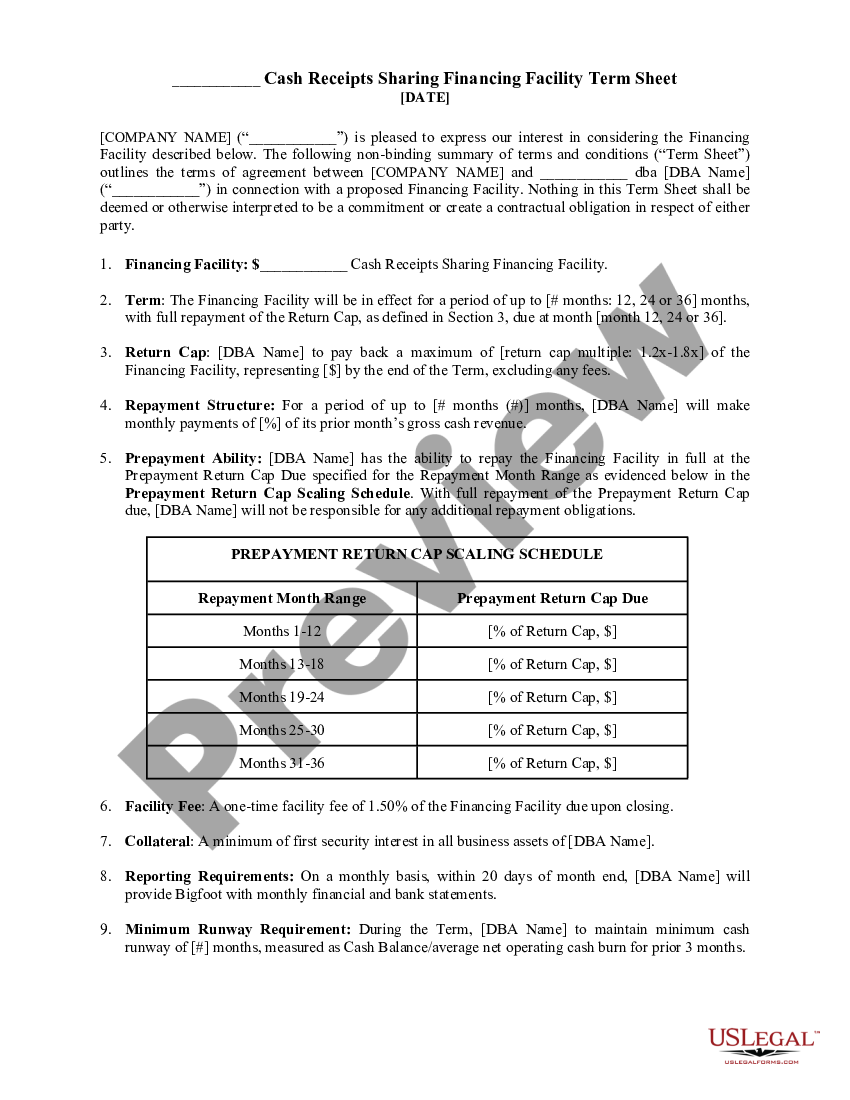

Choose instantaneously from your own customized re-finance solutions on the internet otherwise chat it done with the loan team. Lock in your new speed and lower percentage punctual having offers private so you’re able to Pros Joined homebuyers. step 3

The current Rates

The low-Price Radar taps into stamina of Va Improve Refinance program, an exclusive work with getting Veterans that will help lower your month-to-month percentage fast with reduced documentation and you will meaningful coupons.

Deals You to Number

All of our All the way down-Speed Radar constantly measures up the business prices into rates in your financing to see when a Va Improve can save you currency.

Homeowners eradicate the home loan repayments by the normally $168/mo 1 . That makes to own high offers along side lifetime of the loan.

Designed Deals Selection

Cost are not the only consideration that have an effective refinance. This is why you are getting individualized offers choices you to reason behind things like how long you want to stay in our home, how much cash you’ll save along side lifetime of the mortgage, and much more. You select the deals bundle that is right for you.

Hassle-100 % free Coupons

Virtual assistant Streamlines were made to rating Veterans to the a lesser speed prompt. People get this simple, low-pricing refinance inside action in just a few ticks. All of our Lower-Speed Radar along with your Va Improve benefit make for a powerful few.

I never ever end checking for deals.

Get your brand new home toward comfort you to we are going to never ever prevent in search of all the way down costs and you will large offers after you romantic. dos Just with the reduced-Rates Radar of Experts Joined.

2 Susceptible to capabilities and you can accessibility. Some limits could possibly get incorporate. Means a recently available Va Loan having about seven done month-to-month payments. In some issues, more commonly that have dollars-aside re-finance financing and you will non-Va re-finance products, a consumer’s total loans costs may be higher across the life of the loan which have an effective re-finance. Talk to the loan group about your certain disease and advantages.

step three Coupons start from subsequent rates decrease and/or waived or shorter origination costs. Some limitations could possibly get incorporate. In a number of circumstances, commonly having bucks-away re-finance money and non-Va re-finance products, a consumer’s overall money charges are high over the life of one’s loan that have a beneficial re-finance. Talk online payday loan Trinidad CO with your loan group about your certain state and you will masters.

- Site Chart

- Confidentiality & Protection

- Certificates

- Fair Credit

- Copyright

- Accessibility Report

- Assist

- Register

#step 1 Virtual assistant Bank: Experts Joined Mortgage brokers given so much more Va Lenders from the volume than nearly any other lender at the time of . Finest Va Purchase Lender per Financial Year ranging from 2016-2023. Source: Institution off Pros Affairs Financial Statistics

A Virtual assistant acknowledged bank; Not supported otherwise backed from the Dept. regarding Veterans Points or any authorities agency. Registered in most 50 says. Customers that have questions regarding all of our loan officials as well as their licensing get check out the Nationwide Home loan Licensing System & Index to find out more.

*Veterans Joined Mortgage brokers and Pros Joined Realty render «Get, Promote and you will Help save,» a bundled provider program to possess Experts Joined People. Qualified Consumers gets a lender borrowing equal to one-hundred (100) base facts of your own amount borrowed, which can be applied to both speed or closing costs or a combination of both. Depending on markets conditions, one hundred (100) base issues try approximate to one-half (.5) off a portion point. Including, of course maximum markets standards, a qualified Consumer create select the Financing speed down of six% in order to 5.5%.

Qualified Users must match the following the standards become eligible for the offer: a) list a house available with a realtor by way of Veterans United Realty’s advice community, having checklist to occur zero later on than just 90 (90) weeks following the closing of your acquisition of this new home, b) buy a house which have an agent by way of Pros Joined Realty’s advice network, and c) get 30 (30)-seasons fixed rate resource on domestic pick having Veterans Joined Lenders.

Private listing arrangement should be provided and may were a conclusion go out one runs after dark closing go out out of household get, and and this affirmatively claims a list go out out of no later than just 90 (90) weeks after the closing of purchase of the newest house.

All of the real estate company preparations must be throughout the identity from the consumer and you may/or co-debtor. In the event your family checklist deals closes in advance of acquisition of a great new house, the consumer will get decide to impede using the deal to your acquisition of property at a later time, susceptible to the house get closure within this several (12) days regarding closing big date of the property number business (having much better getting forfeited in case your purchase closure cannot occur contained in this including twelve (12)-month period). About absence of an enthusiastic election because of the Customers, the use of the offer could well be defer pending, and subject to, a fast pick closing, if any, as the described a lot more than.

That it bring is not applicable to USDA money, second lien finance, advance payment guidelines, otherwise Thread Applications. Can not be combined with most other has the benefit of.

** Mediocre deals example is dependant on 680+ credit rating, example seven.5% Rate of interest, and $300,000 amount borrowed; actual month-to-month savings are very different according to the Customer’s finances.

Pros United Home loans, A beneficial Va recognized lender; Perhaps not recommended otherwise backed because of the Dept. off Experts Situations otherwise people bodies institution. Signed up in every fifty states . Customers which have questions relating to our mortgage officials and their licensing will get look at the Nationwide Mortgage Licensing System & List to find out more. 1400 Community forum Blvd. Ste. 18 , Columbia , MO 65203