You can find types of mortgage brokers to own the authorities positives available. You’ll find loans to own first time homebuyers, or mortgage loans to order property and no money off. However, did you know there is certainly a particular government-backed financing that really needs zero downpayment, very first time homebuyers can be be eligible for it, also individuals with straight down fico scores, which you can use around the all All of us? Its called an excellent USDA Mortgage, as well as for the police, it’s the prime provider to have home financing.

What exactly is good USDA Mortgage?

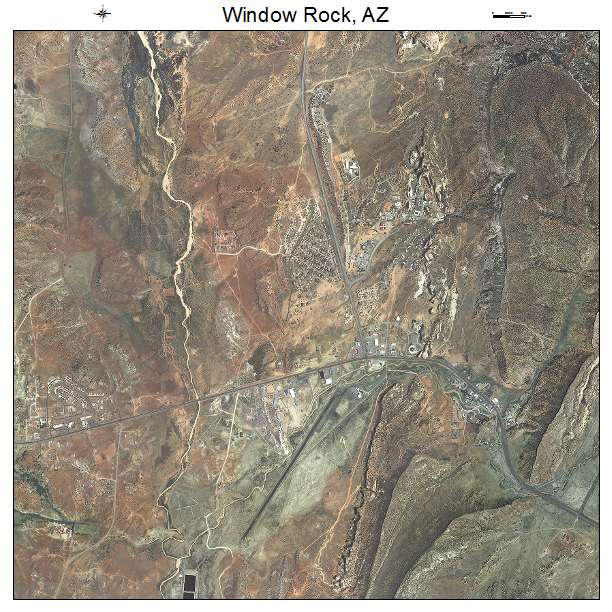

USDA loans are a choice for the police experts or other applicants who wish to pick possessions from inside the outlying components. These types of fund is actually recognized, or covered, by the Us Company out of Farming (USDA). This new USDA talks of outlying since an urban area with an inhabitants out of less than thirty-five,000 someone. Thus, you might believe country or farm when you hear outlying, around 97% of your own United states home is simply believed outlying.

With respect to the USDA, these mortgage loans support lowest- and very-low-money people obtain very good, safe, and you may sanitary casing inside the qualified outlying portion by providing percentage assistance… Fundamentally, USDA lenders allow for anyone, or a household, and work out lowest in order to average income to be qualified to receive homeownership. This consists of very first time homebuyers as well as people who possess had home in earlier times. Before you could end training thinking that your income wouldn’t be considered as you make excess amount, consider this. The amount of money guidelines apply at all the grownups residing in your family. So, if your retired parents accept you, otherwise your grown up youngsters are nevertheless at home, the money tolerance is large. Discover what the cash qualification is in your state.

USDA Lenders having the police give low interest rates, plus don’t want a downpayment. It is an excellent option for low income earners who happen to be finding it difficult to come up with good 20% down-payment to possess a house. Also, they are ideal for people having all the way down borrowing and that’s incapable to qualify for old-fashioned loans.

As the demand for law enforcement in rural portion often is large, then chances are you might need to go on to a far more rural town at some point in your career. Otherwise, perhaps you may be currently leasing inside the good USDA-defined outlying city and therefore are looking to buy a property. USDA Mortgage brokers do not need to be used by very first date home buyers often. They may be always create a property towards the land, or perhaps to remodel a current family. Good USDA home loan is an excellent choice for any of these state, if you be considered.

- Zero necessary down payment.

- There is absolutely no penalty for those who spend the money for loan right back ultimately.

- USDA mortgage brokers possess reasonable and repaired rates.

- Loan terminology are 33 age, meaning you may have you to definitely a lot of time to expend the borrowed funds right back.

- USDA financing don’t have a credit lowest to meet, but most lenders have a tendency to request a score out of 640.

- Financing can be used to create a property in addition to pick a home.

- For many who currently are now living in a rural area and meet the requirements, this type of financing can also help refinance or remodel your existing domestic.

Requirements to possess a beneficial USDA Home loan

USDA mortgage loans do have extremely tight requirements that must the be found to get qualified, yet not. If you are not sure if your or the possessions you wish to purchase is approved, you can make use of that it device on USDA to check on the newest system details to suit your county. You may also keep in touch with a casing having Heroes mortgage professional, who are in a position to walk you through the requirements and you can all your valuable issues. As well as, our very own loan specialists possess reduced fees to have law enforcement heroes and you will other heroes particularly instructors, health care workers, army, EMS, and you can firefighters. This is simply one of the ways Belongings getting Heroes can payday loan Newton help save you a whole lot more in your domestic get.