The will to extend a financial enabling hand to help you family-if in the way of an advance payment on the a different domestic, a connection loan when times turn tough, or even an advance into a heredity-is pure.

Practical question was: What is the most practical way to help? Should it be an absolute provide? Or financing? The clear answer is dependent on your needs, because there is chain attached.

Gift suggestions

Gift suggestions of $18,000 otherwise shorter each individual belong to the fresh new yearly «present difference» for tax purposes. Whether your provide exceeds one amount, you should report it on the Internal revenue service into the Means 709.

Don’t allow one set you regarding, even though. You may not fundamentally are obligated to pay taxes with the large presents, and if you haven’t exhausted new life present income tax exception of $ mil for every single private ($ mil getting good ount you might provide taxation-totally free during your lifestyle. Keep in mind, even though, your exemption would be cut-in half at the end from 2025 until Congress stretches so it provision.

When you have significant form, and you are primarily concerned about your taxation publicity, this may be ily players until then windows closes, and people will likely be interviewing the attorney today.

Bear in mind, too, that if you has actually financial assets that have diminished into the value, you might imagine gifting them while they are off, while the one future love perform take place in the fresh recipient’s house.

Loans

Those who should not provide an absolute current you may think an enthusiastic intrafamily loan. This kind of plan can remind fiscal abuse by the obliging the newest person to make regular payments.

Before you could increase that loan in order to family relations, not, know that it isn’t as simple as just writing an excellent have a look at. The Internal revenue service mandates one to people financing between family unit members be manufactured having a signed composed arrangement, a fixed payment schedule, and you may at least rate of interest. (The newest Irs posts Appropriate Government Rates (AFRs) monthly.)

Any time you are not able to fees a sufficient interest rate, the new Internal revenue service you are going to eliminate the attention you failed to gather since the something special. Additionally, if your financing is higher than $ten,000 or the receiver of loan uses the bucks so you’re able to establish earnings (such as for instance using it to shop for stocks otherwise bonds), you’ll want to declaration the interest earnings on your fees.

There is also practical question off delinquency to consider. Whenever a relative can not pay that loan, the lending company rarely reports they to a card agency, never ever head a collection company. Although not, if the lender need to subtract a detrimental financing on their taxes, this new Internal revenue service demands proof of a you will need to collect the unpaid finance.

Having said that, should your financial would like to forgive the mortgage, the brand new delinquent matter might possibly be treated once the a gift to possess taxation objectives. Next, the new borrower can get are obligated to pay taxes for the remaining outstanding attention. (The guidelines try even more complicated should your financing is known as a personal home loan, it is therefore better to demand a qualified taxation advisor or monetary planner just before finalizing the facts.)

Nevertheless, don’t you will need to disguise something special while the that loan. An enthusiastic intrafamily financing requires a proper design usually the brand new Irs commonly contemplate it a gift. It a significant material if you have currently made use of their lifetime provide different and you will, therefore, get result in an immediate tax.

With the most recent good house taxation and you can present income tax exemption restrictions from mil for every single personal, this can check this be not an issue. Yet not, if the difference be paid down off 2026, this can be way more difficult.

End up being one to because it ily member may help him or her save yourself a tidy sum for the interest repayments along the lifetime of the loan.

All in your family

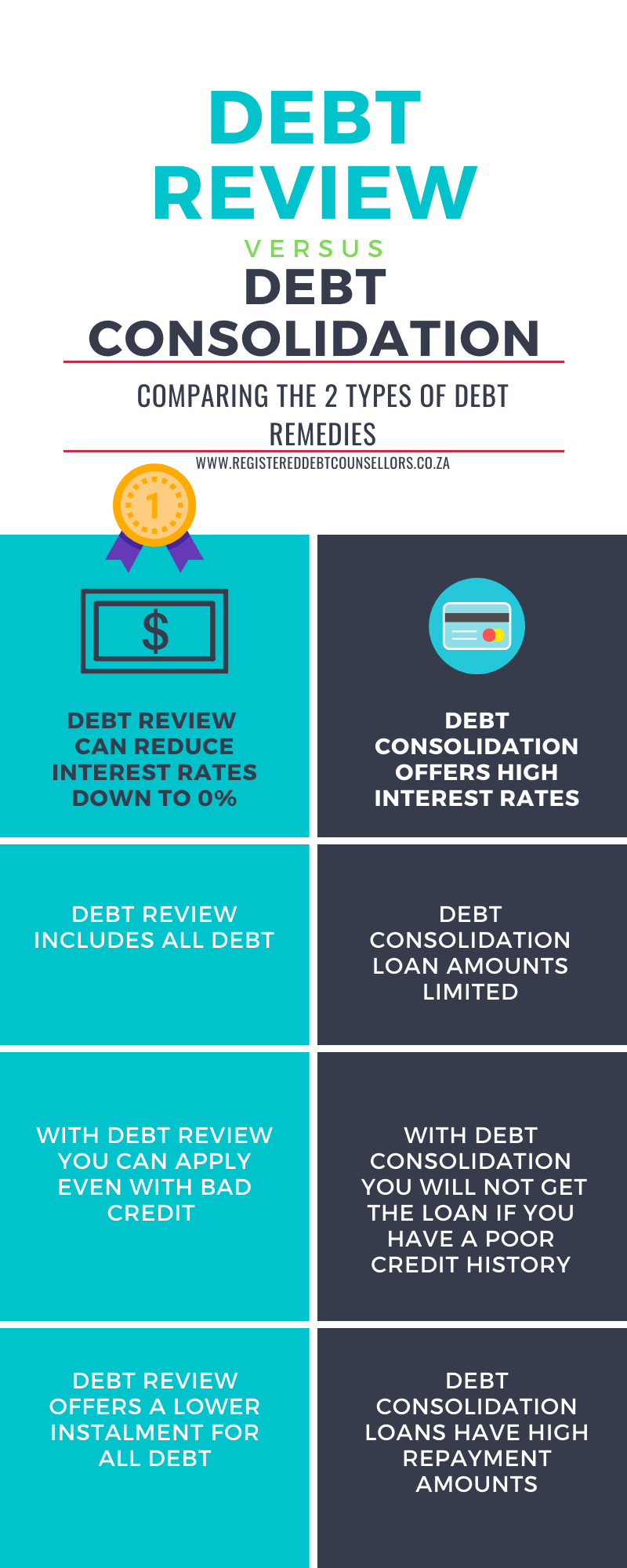

Intrafamily loans, in fact it is offered at prices below people for mortgage and personal finance, may help consumers save larger into the desire.

1 , . Total attract paid down assumes on a fixed rate of interest compounded a-year and you can financing name of 9 or even more decades.

2 Bankrate , mediocre speed by 6/. Full appeal reduced assumes on a beneficial fifteen-season fixed-price home loan and you may good 20% deposit.

step 3 Bankrate , mediocre price by 6/. Overall focus paid down takes on a fixed rate of interest and you will a credit get regarding 720 to help you 850.

Instances given is to have illustrative intentions merely and never intended to feel reflective regarding abilities you can expect to go.

Family members personality

In the long run, whether to give a gift or extend financing ilial matchmaking plus the characteristics of one’s people in it. Almost any highway you are taking, telecommunications is vital, especially if function traditional.