Financing was signed up to build 20 this new dams also to illustrate citizens best soil government. This new hydroelectric electricity produced by the fresh new TVA is actually offered on societal in the reasonable prices, prompting complaints out-of individual fuel firms that the government are to present unjust competition. In the near future flooding handle ceased getting a problem and you may FDR felt most other local programs.

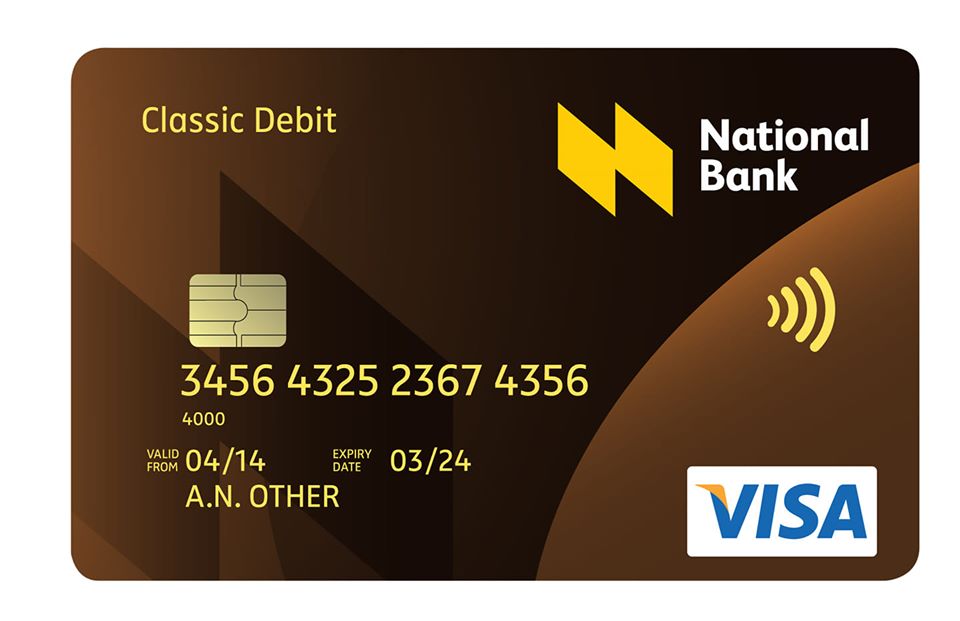

The homeowners Financing Enterprise generally bailed out defaulting home buyers by change bodies bonds getting crappy mortgages

There is no end into alphabet soup. The Securities and Change Fee (SEC) was designed to act as a watchdog on the stock exchange. The home owners Loan Business (HOLC) invited home owners so you can re-finance mortgage loans to eliminate property foreclosure or even to generate renovations. The usa Houses Expert (USHA) initiated the idea of regulators-possessed reasonable-earnings construction plans. People Really works Management (PWA) composed thousands of operate because of the authorizing the building off paths, links, and dams. The Federal Teens Government (NYA) provided people with work-investigation services. The new Federal Work Interactions Board (NLRB) was designed to protect the right off cumulative bargaining in order to serve as an effective liaison ranging from deadlock commercial and you may work teams.

Insurance coverage of the FHA desired getting mortgage loans as repaid month-to-month, forming a holiday marketplace for mortgage loans

Experts bemoaned the huge will cost you and you will ascending national loans and you can spoon-serving Us citizens. Regardless of, a number of the software included in FDR’s «alphabet soups» exist even today.

Contemporary housing rules in the us keeps changed away from big financial occurrences on the twentieth century. The great Despair noted the start of these catalysts just like the poor economic crisis in the usa strike the houses s had been restricted and wages was all the way down, partially due to poor labor unions. While the stock-exchange crashed in the 1929, President Hoover and his successor, Chairman Roosevelt, needed to reconcile with the homes crisis and create the latest regulators institutions to resolve these issuesthe initial of the form.

The largest casing problems for lower-income Us americans was the new substandard requirements of one’s property inventory and you may insufficient entry to home ownership to possess lowest-money group. Homeownership try less of a priority being a renter was a lot more socially acceptable, just like the financial support a property try out-of-reach for the majority lower-income Us citizens. Congress passed the new Crisis Rescue and you will Construction Act off 1932, and that developed the Reconstruction Financing Corporation (RFC), allowing finance companies so you can give so you’re able to personal firms that provide construction to have low-money home. In identical 12 months, Chairman Hoover accompanied your house Financing Banking system, hence contains 12 Federal Home loan Banks and you can a national Mortgage Board. not, Hoover’s the new 20000 loan online bad credit program are outpaced from the growing unemployment and you may owning a home went on to decrease so you can several-fifths of the many households inside 1933.

The latest National Homes Operate enacted inside the 1934 under FDR designed the brand new Government Houses Management (FHA) on goal to change housing criteria giving borrowing getting household fixes and family requests. The brand new FHA are reported to own aided twelve billion someone boost their life style standards, but this matter ignores new discriminatory credit practices entitled redlining, a network new FHA therefore the Family Owners’ Financing Enterprise put to help you amounts the latest profits of areas. The brand new five categories have been environmentally friendly (best), blue (still common), red (obviously decreasing), and you can yellow (hazardous). These types of grades was basically mostly according to the neighborhood’s racial, ethnic, socioeconomic, and you will religious composition. Light, middle-classification communities received FHA loans whereas Black and Hispanic areas had been deemed harmful and you will decreasing inside the value and you may did not receive FHA covered mortgages otherwise fund. Redlining will continue to affect the intergenerational useful Black colored and you can Latina Us americans on account of these types of discriminatory zoning and financing practices.