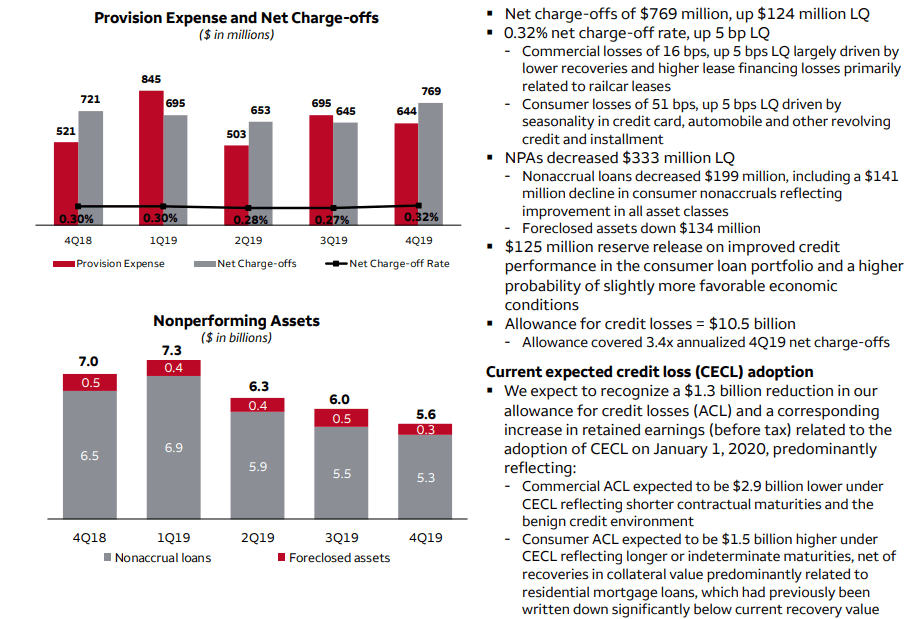

Missing Capital Options

When you yourself have find a lump sum payment number, it can be utilized for financial investments in the place of paying the established loan. Mutual funds, SIPs, holds, FDs and can give you high returns on your money that you can use to settle the loan. In that way, you can generate as well as repay the loan easily.

More Can cost you Involved

Regardless of if RBI has asked banking companies to not levy penalty fees on the floating-rates mortgage prepayments, few lenders nonetheless demand penalties, particularly if it is a fixed-rates loan foreclosures.

In case the financial is considered the most all of them, you may need to incur additional can cost you, which is heavy on your own pouch according to the a fantastic otherwise unsettled number.Seguir leyendo