On this page:

- How come Mortgage Prequalification Works?

- Can be a home loan Prequalification Connect with The Borrowing from the bank?

- The way to get Your own Borrowing from the bank Able getting a mortgage

- Display screen Your Borrowing from the bank When you shop having a home

Taking prequalified getting home financing likely would not connect with the borrowing from the bank, it can help you regulate how far you might use. Essentially, the fresh new prequalification techniques is quick and easy. Immediately following a loan provider reviews their basic borrowing and monetary recommendations, it can know if you’re likely to qualify for a mortgage, the sorts of mortgage loans you can buy therefore the limitation amount you could acquire.

Why does Home loan Prequalification Work?

A home loan prequalification might be good starting point if you’re looking to purchase property. The process varies by the financial, nevertheless can expect is requested some elementary recommendations regarding the financial situation. For example, a loan provider might want to discover your earnings, their monthly bills, how much cash you spared for a deposit as well as how much we should borrow.

Some lenders may also determine your credit having a silky query-a variety of credit score assessment that will not impression credit scores-or request your own projected credit history variety. You can get a free of charge FICO Score ? 8 away from Experian to make use of as a keen approximation, whether or not mortgage lenders will fool around with older FICO Get designs.

Understanding your money and you will credit support a loan provider dictate the loan amount you can afford to spend as well as the chance your expose once the a debtor. In line with the information it pick, the lending company normally prequalify your for different style of mortgage loans and you may an estimated loan amount. You’ll be able to located a good prequalification page, which you are able to tell household manufacturers and you will realtors to display which you’ll be capable purchase property.

Normally a mortgage Prequalification Affect Your Borrowing from the bank?

For as long as the borrowed funds prequalification simply requires that display a projected credit rating, or even the bank inspections the borrowing from the bank having a soft eliminate, your borrowing won’t be impacted.

But not, because the lenders generally don’t be certain that your information to own mortgage prequalification, it could just offer you a crude guess. While you are ready to do something and show you will be big, you could test discover preapproved getting a mortgage rather.

Financial preapprovals should be distinct from prequalifications. They tend getting alot more rigorous-much like the real financial software procedure-and require confirmation data, particularly duplicates from shell out stubs, financial statements and you will taxation statements. Home loan preapproval also can want a hard credit check, and therefore getting preapproved to own a mortgage may harm your own borrowing from the bank. You have to know, although not, your credit score spoil of this a single hard inquiry, if there is any whatsoever, was moderate and you can short-term.

Still, getting preapproved will be sensible when you’re ready to generate an offer, due to the fact you should have a far more certain concept of the sort of home loan and you may number you could potentially qualify for into the lender. Also, in the competitive housing places, being preapproved you are going to give you a leg with suppliers whom want to take on now offers from buyers they understand normally follow-up with the render.

(Know that some lenders often utilize the conditions preapproval and prequalification interchangeably, and you may maybe not get everything you predict from a great preapproval. If a lender provides a great preapproval instead of confirming all the info your mutual otherwise examining the borrowing from the bank, it can be reduced specific and you will bring less weight than just one to you to considers an in depth monetary photo.)

The way to get Your own Credit Ready getting home financing

From the months prior to your property get, you can make possibility to work on boosting your credit. Your credit file and you may ratings make a difference what you can do discover home financing along with your mortgage’s interest rate, and you want to be from the better standing you’ll be able to. Below are a few things to do to set up:

- Look at the borrowing. For people who haven’t done this currently, check your credit ratings understand where you stand. Plus, comment your credit file off the around three credit bureaus for items that can be hauling down your scores. Past-owed account and you can profile in the collections have a massive feeling on your rating, therefore try everything you might to cease missing costs and catch up As soon as possible should you choose. If you have any charges-off accounts on your statement, make a plan to handle them.

- Pay down the mastercard stability. The borrowing utilization, and therefore tips just how your own rotating account balance compare to their credit constraints, is an additional very important scoring factor. Paying off rotating balance, particularly credit card debt, can reduce your utilization speed, which will help the credit scores. Even though you shell out your charge card statement entirely per week, your balance is generally said after their declaration several months and you may end in a high application price. And work out payments before the end of the charging period will help you retain your own borrowing from the bank utilization low.

- Usually do not get the fresh profile. Starting a special charge card or financing is also damage your credit ratings because it can lower your mediocre chronilogical age of accounts and you will end up in a challenging inquiry. The newest membership makes it possible to build borrowing from the bank when you’re making money punctually, and these brief-label setbacks essentially are not a primary concern. not, it may be best to avoid opening brand new account throughout the months before your financial app.

- Spend all bill punctually. A belated commission can harm their credit ratings, especially if they basic happens. As the lead up to buying a home tends to be hectic, make sure you never miss any statement payments. Or even currently do it, you may want to build automatic money or notification to own bill payment dates.

Screen Your Credit While shopping getting property

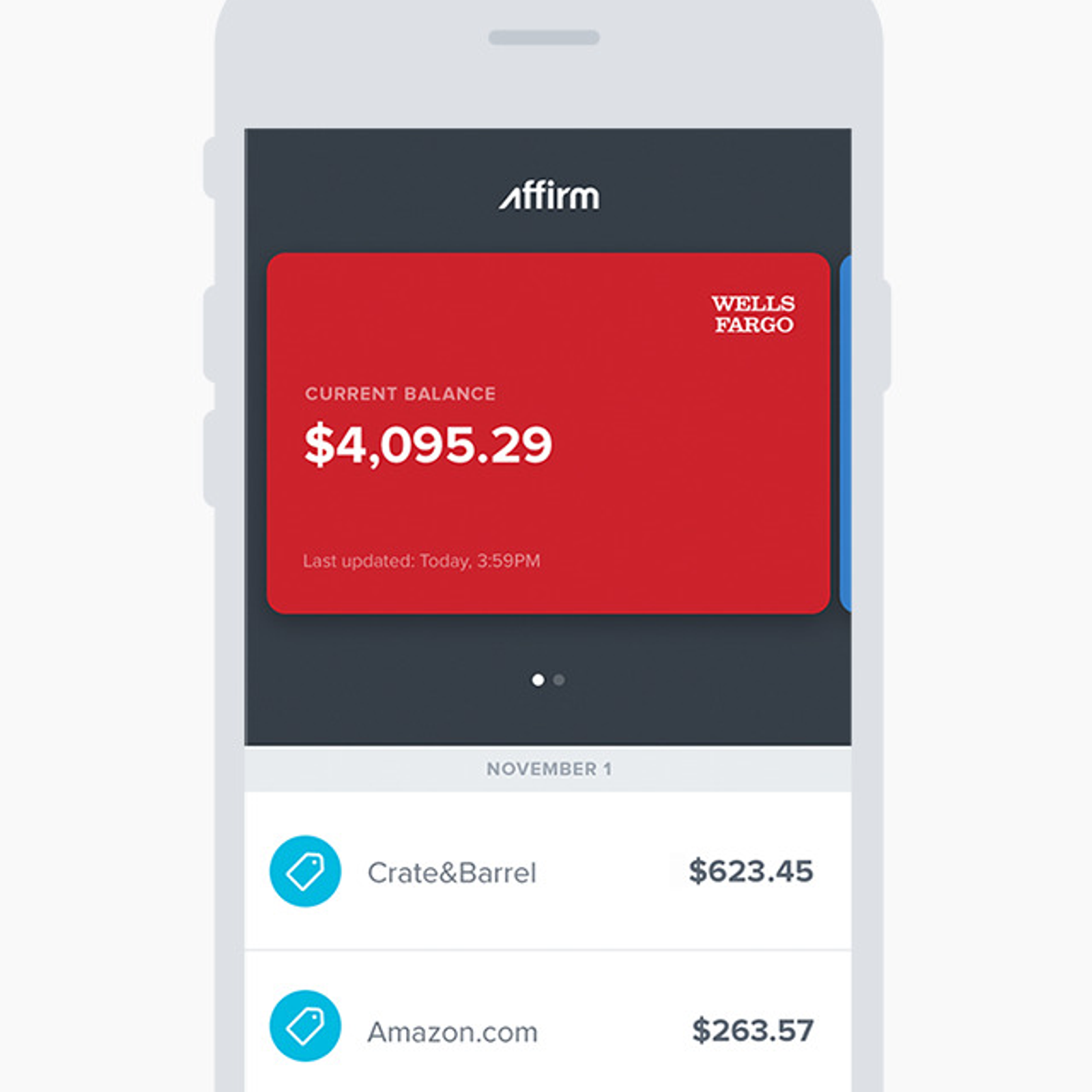

While getting prequalified getting a home loan might not apply to your own credit results, we should ensure that other bad marks dont hurt the borrowing from the bank before you submit an application for such as for instance a large mortgage. A cards keeping track of services you payday loans Appleton no bank account may quickly notify you in order to changes in your credit history. Experian has the benefit of totally free track of the Experian credit report.

You’ll be able to display their almost every other a couple of credit reports as well, just like the mortgage brokers can use the around three of your reports and you will credit scores predicated on per report. The fresh Experian IdentityWorks SM Superior system has a no cost 31-time demo and you may includes three-agency keeping track of and you may numerous FICO Ratings per report, including the FICO Score type popular to own home loans.