Credit scoring options, which use guidance in your credit file to check your own possibilities regarding failing continually to pay back financing, play an important role in lot of lenders’ evaluation of borrower exposure. But they are a single equipment loan providers fool around with when determining just what interest so you can charge you.

In terms of mortgage software, lenders usually have fun with credit ratings to possess an effective «first solution» comparison regarding creditworthiness, following research trailing the brand new score by firmly taking a cautious glance at their credit history or any other monetary pointers

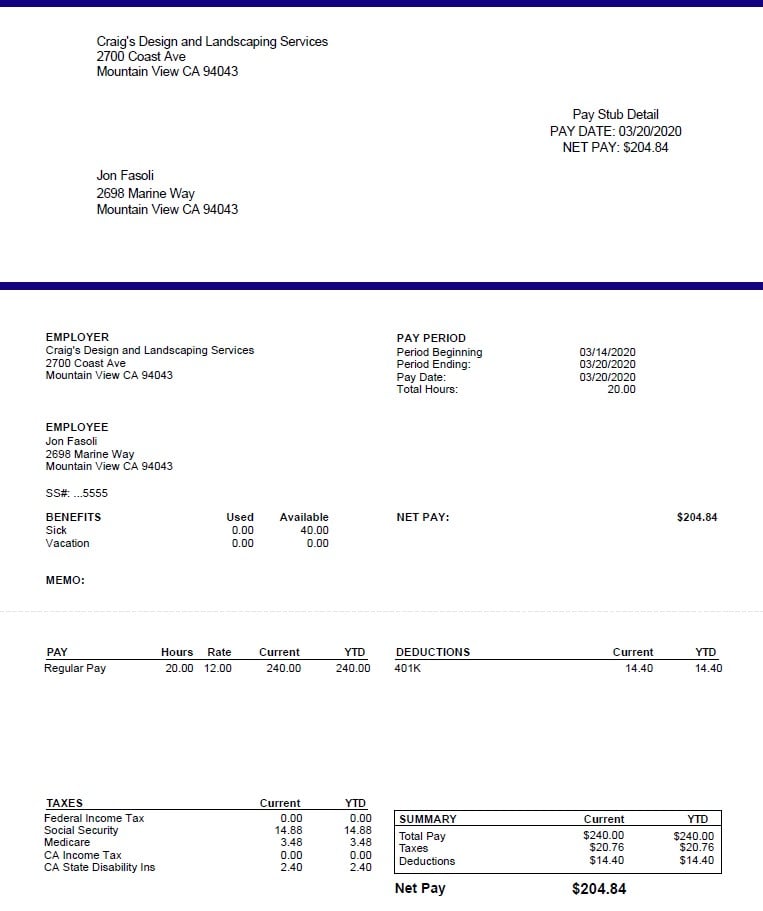

- Debt-to-income proportion: Mortgage lenders usually want proof earnings when it comes to pay stubs or taxation statements, and in addition they absorb your own outstanding bills and you can the total amount you only pay loan providers each month. Debt-to-earnings (DTI) proportion, brand new portion of your own month-to-month pretax earnings you to visits loans payments, is a vital determine of one’s power to defense the fresh new expense. As your DTI ratio grows, thus really does the identified chance; large DTI rates may for this reason bring large desire costs.

- Advance payment: Conventional mortgage lenders prefer a down-payment regarding 20% of your own house’s cost, but some lenders allows you to make a lower life expectancy down payment. They typically charges highest rates of interest just like the a tradeoff, and also require one to buy private mortgage insurance (PMI) to guard him or her against financial loss in instance you neglect to pay-off the loan. Alternatively, whenever you establish more 20% of your own purchase price up front, you’re in a position to negotiate a diminished interest rate.

- Loan title: Typically, you can purchase a reduced interest for people who search (and you can qualify for) that loan with a smaller payment title-an excellent 15-season home loan as opposed to a thirty-12 months you to definitely, for-instance. Your given amount borrowed, a shorter-label financing will bring high monthly premiums however, down complete desire will cost you.

Fico scores is a good distillation of the guidance on the borrowing from the bank accounts, hence file your own reputation of borrowing currency, having fun with credit and you can and work out financial obligation costs

Due to this fact, before applying to have a home loan, it’s smart to bring a mindful check your own borrowing profile out-of every around three federal credit bureaus (Experian, TransUnion and Equifax). Doing this can help you room and you may correct wrong entries one generate a bad impact (minimizing your credit ratings), and will together with help you allowed and plan issues lenders have regarding the credit history. You can purchase a totally free credit history regarding Experian, TransUnion and you will Equifax from the AnnualCreditReport.

When it comes to home loan apps, lenders generally use credit scores to have an effective «very first ticket» assessment out of creditworthiness, after that search behind this new ratings if you take a careful consider your own credit history or any other financial information

- Later otherwise overlooked costs: This new effects of late costs on your own credit rating disappear throughout loan places Cottondale the years, so a belated percentage produced several years ago may not have a big influence on the score, it you’ll bring a loan provider pause. You could probably identify away an isolated incident due to the fact an honest error, but if your records includes multiple missed money, you may need to bring a far more intricate membership-and a conclusion off how possible stop repeated men and women missteps during the the long term.

- Charge-offs otherwise accounts into the range: In the event the a loan provider cannot gather a debt away from you, they may close your account (a system known as a fee-off) or promote the debt so you’re able to a portfolio agencies, and that assumes the authority to follow your with the unpaid loans. Charge-offs and you may range records stick to your own credit history getting 7 age. Even although you at some point pay the collection agencies (or perhaps the completely new collector), the existence of these types of entries on your own credit reports you are going to deter a home loan company.

- Biggest derogatory entries: In case your credit history include a mortgage foreclosure, car repossession or bankruptcy, loan providers are likely to come across warning flag. All are proof obligations that has been maybe not paid back considering totally new lending preparations-things one understandably build loan providers wary. These entries is also stay on the credit reports to own eight so you’re able to a decade, which have elderly records thought to be less worrisome-which quicker damaging to the fico scores-than simply new of them. Still, if you have any of these records in your credit report, some mortgage lenders may start off the loan application entirely. Lenders ready to consider carefully your app will predict you to define brand new negative entries, and have proof you could end comparable points progressing.