Find out more

While an aspiring investor you are more than likely knee-deep in the research. There are many variables you should believe, off discovering the right area, the kind of possessions and even the kind of financing. When it comes to securing a financial investment loan, you have in all probability the possibility to choose anywhere between a main and you will attention financing otherwise an appeal just investment financing, the latter being a familiar choice for dealers. Contained in this writings, we discuss the essential difference between every type off mortgage while the role they play in your much time-title resource strategy.

What’s the difference in a primary & focus (P&I) loan and an appeal simply capital mortgage?

A principal and you can attract loan is the perfect place you only pay interest and you can incremental portions of the matter you owe the fresh new principal’ at the same time.

Having a beneficial P & We financing, you will be making payments towards real property from date that and you will full, it can probably become a far more costs-productive alternative. Given that a trader, it’s also a reduced high-risk option. Do you know what your payments are from the beginning, and you are building equity that could help to assistance coming expenditures.

An interest merely funding loan form exactly that. Youre generally paying down only the focus to the mortgage amount. You are not making one repayments into dominating amount borrowed.

Basically, none choice is much better than the other. Best particular mortgage for you differ according to your needs as well as your a lot of time-term financing method.

Which are the great things about an appeal merely capital mortgage?

Attract just loans are one of the indicates people will keep their will set you back down. In this instance, they’re not repaying the loan financial support (the principal), and so the monthly money was lower than a principal & focus financing.

An attraction merely financing enables you to get into the marketplace and build funding development if you are still accessing more cashflow. From the income tax date, you happen to be in a position to counterbalance the attention you’re expenses and you https://elitecashadvance.com/loans/single-payment-loans/ can qualified possessions costs up against one local rental earnings you obtain. By not having to invest the mortgage prominent very first, traders can be reallocate those funds for the non-tax-deductible expenses and you may capital most other possessions, particularly, decreasing the financial obligation on the dominating host to household.

Inovayt Handling Movie director Nick Reilly says, Investment funds is tax-deductible, generally there is oftentimes nothing part cutting those individuals financing unless you enjoys totally paid down your house loan that isn’t tax allowable.

What are the threats and you may effects of an interest only financial support mortgage?

In a way, an appeal simply investment financing try creating an incorrect cost savings. The lower repayments relevant helps make resource characteristics appear more affordable than simply he’s and if the eye just several months concludes, unprepared traders will likely be trapped off guard by the a life threatening increase into the repayments.

Notice simply funds are considered a riskier selection. As you are not reducing all matter you borrowed from, you are not building people equity in your assets profile. it means, ultimately, you might shell out over you’ll with good P & We mortgage.

Brand new Australian Securities and you can Financial investments Commission (ASIC) broke along the costs throughout the years. Considering an excellent $500,one hundred thousand P & We loan more three decades; the common consumer perform spend doing $579,032 inside the appeal that have a reliable interest out of six%. When you yourself have an appeal just months to possess a duration of 5 years, a customer will pay up to $616,258 overall. That is a supplementary $37,226 compared to if you had a P & I financing.

Nick explains one even though it is good locate an attraction simply financing today, you happen to be during the yet another reputation come five years’ big date. Five years ago, you’ve got had the solution to acquire desire merely, however, anything have altered subsequently. You have got lost or quicker your revenue which means indeed there are a couple of associated risks, and you can remain which have payments which might be uncontrollable. This is where the thing is pushed attempting to sell therefore function someone have to sell at the completely wrong time and potentially forgo possibilities to construct wide range.

If you have an appeal merely financing mortgage, just what possibilities do you have when the desire merely several months works out?

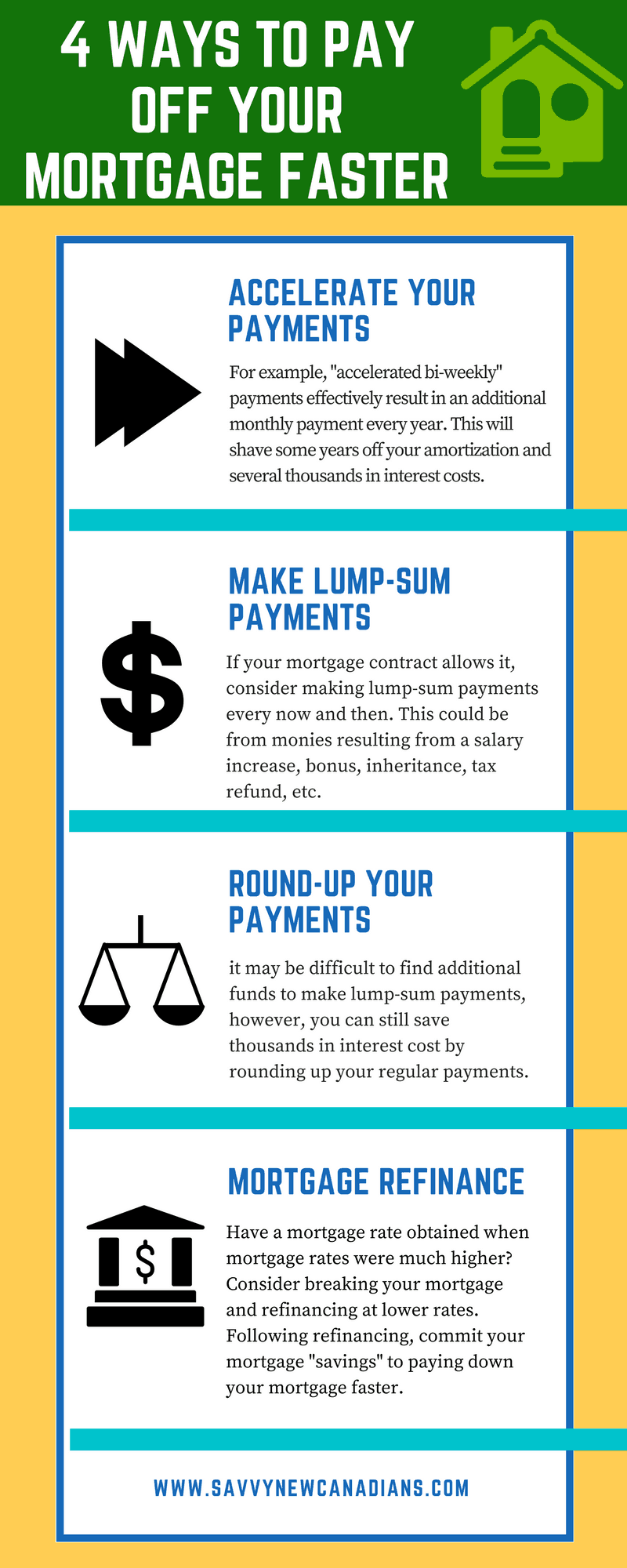

Refinance: In the event your end of the desire just several months is actually sight, it is worth looking for ways to see if there are many more top options offered. There could be most other way more aggressive mortgage brokers otherwise funds with better-eliminate have with the means. From time to time, you may want to have the ability to increase the eye simply months. If you are considering refinancing, we advice conversing with a skilled funds otherwise mortgage broker.

Continue the attention just months: With a few loan providers, you really have the option to give the attention simply period. But not, it’s worth taking into consideration what this implies for the capital means much time-label, observing that alternative will likely charge you even more over the years. You are able to have to experience most borrowing from the bank monitors throughout the lender to be sure you are however capable conveniently build your payments. Due to the more costs and you will chance, it is worthy of talking-to your own accountant otherwise monetary coordinator just before continuing as they begin to have the ability to make it easier to think about the most readily useful short- and you will long-title measures.

Switch to a great P & We financing: If you are a savvy trader, it is likely youre already across the ins and outs of your loan. You are currently wanting your loan will revert so you can P & I and you invited so it option. While your payments will increase it can indicate you are using focus and settling the loan prominent.

For all the they, Nick claims, A very clear technique is what is important. You ought to consider your desire having paying. Have you been attending purchase a good amount of characteristics since you was a top-money earner and you’re immediately after a taxation deduction? In this case, attention merely will be the approach to take. But, for individuals who just actually want to buy two financial investments, its worth considering P & I as you have a secure strategy in position comprehending that might individual the house or property after the borrowed funds label when comparing to an interest-merely mortgage in which you need to remark the loan terms and conditions all five or so many years.

Clearly, i don’t have fundamentally the right otherwise wrong types of mortgage. One another financing products have positives and negatives. Ultimately, deciding on the best financing type of varies according to your existing financial problem plus complete capital approach. Only a few financial support money will be attention totally free finance. When you find yourself an attraction only money loan frees enhance earnings, over the years, you will be charged you way more fundamentally for folks who do not find elite monetary guidance and package consequently.