You may still be capable of getting a mortgage no employment, but it’s more challenging. If you can prove to a loan provider which you have an effective considerable family savings, enough property or a choice income source, it may be you’ll.

Do Mortgage lenders Glance at Deals?

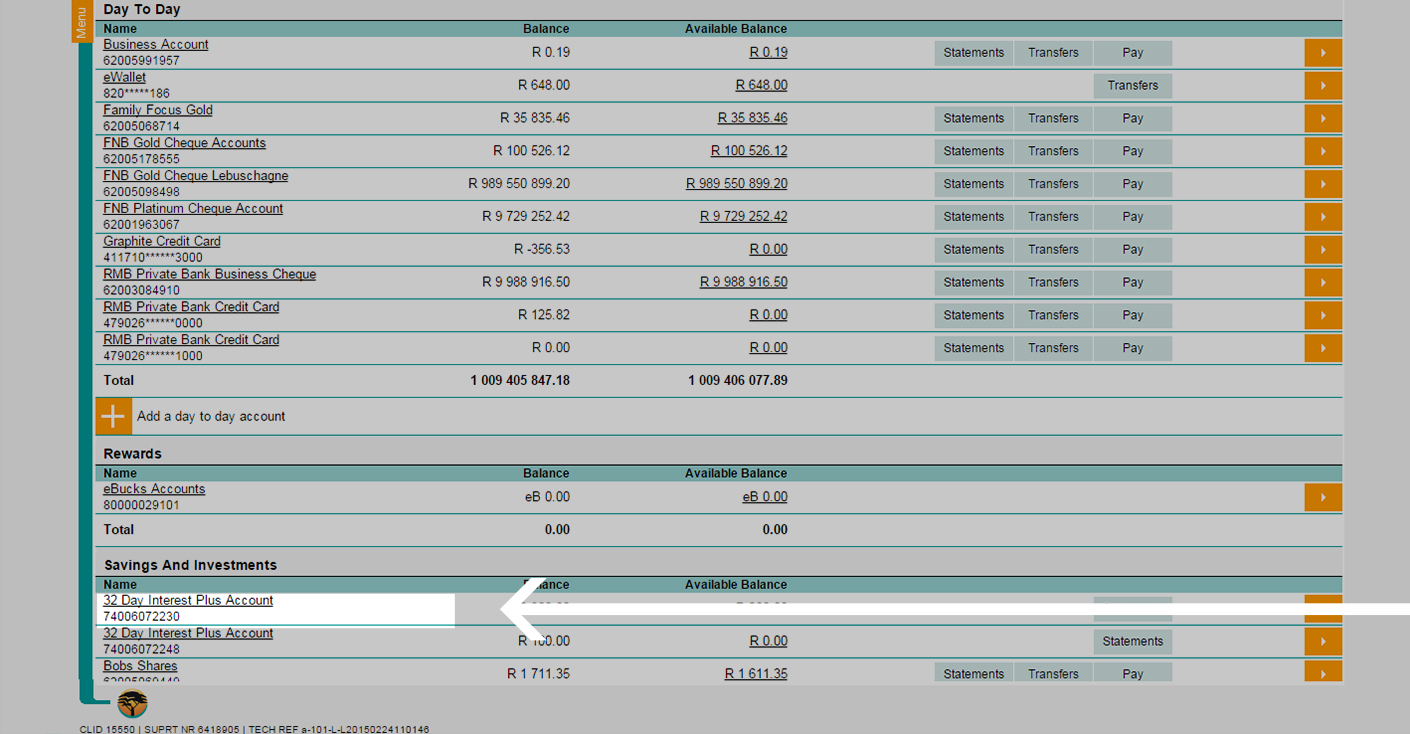

Mortgage brokers will any kind of time depository profile on your own bank statements; this may involve people checking and you will deals accounts also one unlock lines of credit. Ergo, if you don’t have a typical money out of a career, lenders commonly however be the cause of your own discounts to assess mortgage cost.

If you wish to focus on the offers in order to mortgage brokers, it is strongly recommended indicating loan providers which you have sufficient money stored; the equivalent of six months or even more of spend stubs.

Do you really Get home financing for those who have No Job?

When you’re currently underemployed, whether from the alternatives or immediately following dropping your work, it can be more challenging to help you secure a home loan. Lenders normally examine good borrower’s income to assess how much cash he’s willing to loan. Contained in this, many loan providers will even establish at least earnings.

But not, certain mortgage providers be flexible than the others in the manner they define income. If this is the situation, these lenders may deal with deals accounts as long as you is also show that your monthly income is enough to satisfy payments.

While you are unemployed, you are going to always have to have an effective credit history just like the better since the be able to lay out a ount of off fee to safer a home loan. Often, no-earnings fund, also mortgage loans, may come that have large interest rates and you will not be able to obtain as much money.

How will you Be eligible for a mortgage When you find yourself Out of work?

When you’re making an application for home financing and should not show a position, you will need to have the ability to have demostrated particular way to obtain typical income which could tend to be coupons. Lenders might wanted a beneficial credit score. No matter whether youre unemployed because of the choices, for example bringing retirement, otherwise have lost your job, you will need to persuade one lender you could generate normal costs punctually.

A good way that you may manage to be eligible for a great financial whilst out of work is through with a great co-signer; this can be a member of family, partner or pal. So it co-signer will need to be operating otherwise enjoys a leading websites worth. Co-signers make financial less of a danger toward lender because they’re protecting the mortgage with the income and credit records.

Other ways To help you Be eligible for home financing for those who have No Employment

There are many different means you will be able to be considered an effective home loan even although you are not in http://www.paydayloancolorado.net/ full-time employment:

Part-time a job, self-employed functions otherwise gig discount sense whenever you are in a position to prove that you take a keen employer’s payroll to your a partime or freelance basis, it will help the situation having loan providers as long as the fresh new earnings is enough to be eligible for the loan you are trying to to secure. This will show the financial institution which you have been able generate a pretty steady income and possess were able to service your self economically.

Diverse types of income unless you get one full-date jobs but could prove that you convey more than one to source of normal performs, it helps expose your self while the economically secure to your possible loan providers.

Income tax fee exhibiting loan providers the tax returns may help make certain your earnings, particularly in its lack of normal paychecks.