twenty seven October Home loan Underwriting Processes in the uk | An entire Book

If you’re looking to order a house in britain , there’s an enthusiastic thorough variety of things that should be believed. Off delivering pre-acknowledged getting capital along with your financial to focusing on how far home you really can afford and you may what kind of mortgage usually work best with your needs.

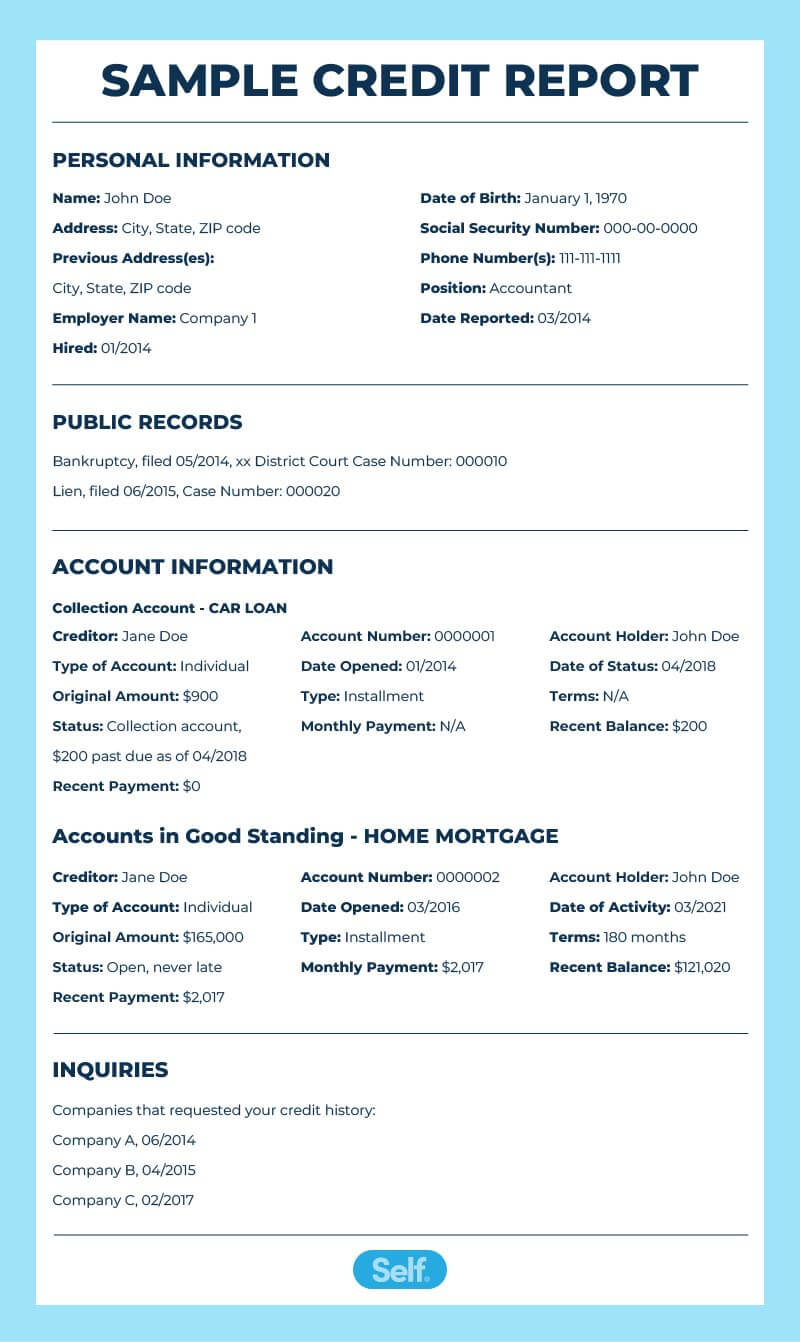

You to challenge we don’t know regarding the ‘s the Financial Underwriting Techniques. This action talks about all facets in your life, and additionally credit history, debt weight, possessions and you can money accounts, before carefully deciding if they need to accept your to have a loan. Knowledge this step using this type of book will assist improve mortgage software techniques more enjoyable!

What exactly is Financial Underwriting?

Financial underwriting is a procedure that relates to reviewing your economic suggestions to determine when you find yourself eligible for a home loan. It offers examining the fresh new borrower’s creditworthiness and capability to pay the loan, in addition to verifying money statements and you will work confirmation.

Guide against Automatic

Home loan underwriting are going to be completed in a couple ways: guide otherwise automatic. Guidelines home loan underwriting involves going right on through each application manually, when you’re automated financial underwriting spends tech and work out choices based on predetermined standards.

Which type of home loan when you do? Well, it all depends about what works well with your! Such, manual handling might work best if an applicant features tricky financial information otherwise need unique assistance from a lender expert within the opinion processes. Likewise, automated control would be finest to own people who are in need of recognition easily plus don’t have any specialised activities available to you.

Just what Checks Carry out Lenders and you can Underwriters Do?

- A review of the home you need to pick

- Your credit rating

- Your credit report

- Breakdown of your credit report: This includes your income, collateral, investments and you can economic assets.

Can be A keen Underwriter Deny Financial?

Many people ponder if mortgage underwriters can be refuse a good financing. The clear answer was, yes capable. Mortgage underwriters have the effect of making certain that anyone obtaining the loan features sufficient income to blow straight back the latest monthly premiums while making they because of any issues such health care otherwise auto injuries rather than defaulting on the financing.

Nevertheless they check your credit rating and you may obligations-to-earnings ratio , together with how much cash you borrowed from inside monthly premiums as opposed to that which you secure per month ahead of fees and other deductions.

Assume a candidate does not have a good credit score but nevertheless matches some other criteria getting recognition. Therefore, particular loan providers you are going to give her or him an excellent non-traditional financial with large interest rates than simply antique mortgage loans.

- You’ll find concerns about this new borrower’s personal debt

- A dismal credit record

Really does a declined Home loan Affect Credit?

Getting refused a mortgage, or financial the theory is that, doesn’t apply to your credit rating. However, which have unnecessary requests for home financing may discourage you from upcoming home loan approvals.

Any time you submit an application for a mortgage the theory is that, the underwriter will run a difficult otherwise mellow take a look at. A softer take a look at is even called a price lookup; these kind of looks may not be demonstrated on your own credit declaration.

Whenever a keen underwriter work an arduous check, it departs a footprint on the credit report the one that coming lenders ple, a loan provider could well be interested as to the reasons you have got did several programs for a home loan.

Therefore, it is best to play with home loan experts, for instance the ones bought at AMS Financial. This means inspections are carried out correctly hence the expected documentations are given to the home loan underwriting process.

Sophisticated Credit rating But Declined Mortgage?

That have a great credit score will not necessarily mean might instantly located a mortgage the theory is that. Indeed, it is far from the one thing you to definitely underwriters and you will lenders just take towards the membership when granting your home financing.

Less than you can find four causes why you are refuted a mortgage, even though you possess an excellent credit score:

- You will find one or more credit rating. Commonly some body legs the credit rating using one gang of requirements. americash loans Green Mountain Falls Although not, financial institutions features a massive people away from statisticians due to their own borrowing score requirements, and they’ll grant you an excellent personalised get.

- Being underemployed or generating less than a particular money class will get put you prone to rejection.

- The debt tends to be too large.

Self employed Earnings Getting Mortgage

Becoming thinking-functioning isn’t going to get in the way people getting accepted to possess a home loan it simply form there will be quite additional process.

Self-work mortgages was considered slightly riskier on the lender’s eyes, that is why you’ll need a comprehensive financial specialist to be sure you really have every necessary requirements having obtaining home financing.

You are thought notice-employed once you individual 20% or even more out-of a share off a corporate of which you earn an income. You might be somebody, company, sole individual or director.